I'm begining the series of MNOs corporate strategy overview. They are made on my own observations and open sources of information (and a little bit of rumors :-) ). You are welcome to make your additions - I will be glad to post your thoughts.

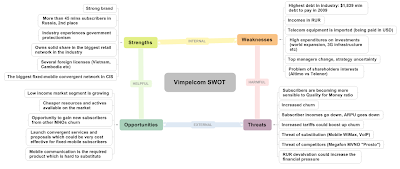

The first part is short introduction to Vimpelcom (based on SWOT - I believe that it is very usefull way of short description of the company) which is pretty interesting to look at now because of its extraordinary situation.

Click to enlarge.

And below you may find current operational focus of Vimpelcom (from 3Q results presentation):

•Cut all non-essential costs

•Execute hiring freeze and identify further headcount optimization opportunities

•Aggressively re-negotiate contracts with key vendors

•Put on hold non-critical CAPEX orders

•Scale back CAPEX plans going forward

•Protect against currency volatility exposure through hedging

Second short overview is about MTS.

Current publich strategy of MTS is following (called "3+2"):

- Provide better subscriber experience. Differentiate network quality. Optimize CAPEX. Develop monobrand retail network.

- Develop data traffic and content based services. Balanced development of 3G and EDGE.

- CIS and developing countries expansion. M&A only in CIS in case of financial ability.

- Effective expenditures. Optimize OPEX. Switch CAPEX to strategic projects maintenance.

- MTS group development. Optimize business processes. Optimize organizational structure.

And finally, Megafon. This company seems to be the major threat for previous two MNOs.

Megafon has cost optimization activities but not so global as Vimpelcom and MTS. They don't have ambisious investments in foreign expansion, big retail network. They are very focused on cost effective proposal (MVNO "Prosto" - http://www.prostozvoni.ru/). At the moment they are performing restructurization (getting into the one company from several regional companies) but still active in their spendings on new solutions. It worths mentioning that Megafon is a closed company and not so limited by getting strong financial results. They are able to concentrate on subscriber base growth rather than USD revenue.

You may find pdf sources at the bottom of the page.

Thanks,

Denis.