вторник, 1 сентября 2009 г.

Mobile Content

MTS Omlet was launched about half a year ago and rapidly increases its popularity by massive advertisement and comfortable payment schemes. MTS anounced its big interest in this new area: multimedia content for PC and Mobiles. Mobile Content is one of the biggest trends now and stands among Mobile Advertisement and Mobile Commerce. While Mobile Ads and m-Commerce are still very immature markets, Mobile Content has already achieved senior level of maturity. Hence it gets more interest from MNOs. They have to develop their business and in the current downtime there are no many ways to do that.

Main drivers for Contet market growth:

1. Growing Russian Internet base.

2. Growing erudition and device capabilities awareness.

3. Growing legal content market share and Government pressure in content legalization.

4. MNOs become broadband ISPs and they are interested in getting money not only from access.

I think it is really good time for getting into this business with small investments (the crisis made all thing cheaper) and protect future incomes. It is clear that MNOs income could be increased not from big increase in penetration but from new services (Mobile Internet, Content, Advertisement, Commerce). And this becomes very important strategic task to take place in the markets of new trends in order to be able to have quick win there later.

Recently Megafon anounced it's plans to launch multimedia Content Portal Trava (like Grass). It seems that they chose the similiar to MTS business model. I think we will see interesting competition soon. Beeline is taking a long pause regarding its plans in this area but it seems they simply don't have resources for a new business direction development. Government held SvyazInvest should think about this area too - they have really big Internet subscribers base and many of them are buying content through Internet. Why not to earn that money too?

MNOs and Internet companies are not the only competitors here. The major players in this competition are handset and devices vendors. Just look at Apple iTunes, Nokia OVI store and you will see many more interested in Content business.

So, Internet companies, MNOs, ISPs, Vendors will be developing Content Portals and compete for the End Users. All of them have their pros and cons. Probably, the winner will be some partnered project. It could decrease investments and risks and increase end user value (and hence revenue for parties involved).

Some estimations of this area:

Fidel turnover is $400k in 2008, 2009 estimated at $570k, 2010 estimated at $1 mln

Fidel and Soundkey both have about 70% market share

MTS investments in Omlet are estimated at $5 mlns

Digital content market size is estimated at $2,4 blns (J'Son & Partners)

Additional information (in Russian) could be found in this Vedomosti issue http://www.vedomosti.ru/newspaper/article.shtml?2009/09/01/212300, http://ruformator.ru/news/article05950/default.asp and here http://hostinfo.ru/articles/business/rubric160/1540/.

Thanks,

Denis.

воскресенье, 7 июня 2009 г.

Mobile Video in Russia

In order to maintain profitability MNO could limit maximum viewing time.

It could be usefull to propose new partnerships to MNOs in video content area because content is a key to success in mobile TV offering. Could Russian MNO develop Italian success story? Or at least USA success? Will see...

воскресенье, 24 мая 2009 г.

The era of convergence

The first global attemp of achieving convergence in Russia was Golden Telecom purchase by Vimpelcom. It is clear (at least for me) that one of main reasons for that was desire to get extra money from owned company. Altimo got approximatelly $1,128 billion income on this deal. Vimpelcom top managers are still concerned with economic effect of this merge, they confirm that it still didn't achieved. During development projects for new services Vimpelcom managers seldom think about convergent effect. At the moment corporate structures continue to merge and the only effect is in the single procurement and problems with areas of interests dividing among managers.But I'm pretty sure that Vimpelcom will manage to build effective mechanism of joint effective business.

MTS approached this theme in more practical way. There is a convergence department and business marketing department that more or less coordinate decisions with Komstar. Today there are a lot of publications and information regarding close merge of MTS and Komstar. Again there is a big desire for this not only because of getting convergence effect but for getting extra money from MTS (AFK Sistema owning Komstar needs extra funds).

Megafon is famous for its inhouse development (as you could see from retail structure development, a lot of development projects) and I think they will make something on their own basis. But during strategy presentation Megafon CEO told that they plan to invest $500 mlns on convergence and maybe we will see aquisition. At the moment Komstar and Megafon discuss buying Synterra.

I'd like to point out new directions for business development after convergence for MNO.

First of all fixed network operators (Komstar and GT) own widespread networks and magisterial licences - it could bring additional cost saving opportunities for MNO. Vimpelcom is already trying to transmit long distance calls through GT networks (frankly speaking it is additional point of failures because GT magisterial channels are not broad and reliable enough).

Second opportunity is in aligned distribution of services (cross sales) - corporate subscribers of fixed operator could be offered with cost savvy proposals from MNO. Thats why in St. Petersburg MTS is partnering with Severo Zapadniy Telecom (SvyazInvest subsidiary in North West region). In case of deep integration and special IT solutions corporate subscribers could be offered with broad range of integrated services like corporate PBX (with mobiles on special short numbers), mobile offices and so on. Homeowners could be offered with single package of broadband Internet, IPTV and mobile services. IPTV is very interesting for MNOs because it could provide content and hence heavy load for 3G networks. It is very nice surprise of mobile Internet popularity despite of hard financial situation but MNO being the tube isn't a dream for "Great Three".

MNO and fixed operator could use single ISP infrastructure for Internet services and offer similiar services in web: web advertising, policy managing, acceleration.

Another significant issue is in integration of fixed operator VoIP infrastructure and MNOs mobility. I belive that soon we will see extremly new proposals on the basis of mobile IP telephony - WiMax competitors continue development and testing of such services - and MNOs will have to make answering proposals.

To sum up: it is good time to offer or at least begin activities for promotion of convergent solutions and new services (MTS continue to invest in new services, there are rumors that GT projects in Vimpelcom still have budgets). Main convergent solutions are:

- WEB advertising (MTS and Vimpelcom have such projects in development)

- WEB policy management

- Internet acceleration

- Mobile PBX

- IP telephony for mobiles

- Three screens solutions (IPTV, WEB TV, Mobile TV)

Thanks,

Denis.

вторник, 19 мая 2009 г.

Mobile Advertising in Russia

Mobile Advertising is not an extremly new idea in telecom world. Significant experience is summarized. There are success stories and big failures. One of the most dedicated to this theme resources is Telco 2.0 initiative with big amount of related articles in their blog. From economic point of view it is very attractive to monetize MNOs Subscriber base which is often very big. 50 mlns Subscribers is more than many TV channels have. This service represents new stream of revenue from media agencies, new market free of competitors now but very attentively looked for.

Foreign experience

Mobile Advertising is a special VAS for insertion of advertisement into channels owned by MNO: SMS/MMS/GPRS,EDGE,3G and so on. The most common ways of advertising are:

- SMS/MMS broadcasted messages with advertisements inside.

- SMS/MMS ad injection in P2P messages.

- WAP/WEB banners insertion - ad injection during Internet surfing.

The most common parameters of targeting are:

- Demographic

- Behaviour

- Context

- Geographic

- Blyk UK, Orange UK based MVNO with ad sponsored services. 2007. Push SMS, Push MMS, SMS Intercept. Airwide (First Hope). 6 incoming messages per day give 43 minutes of calling and 217 SMS per month.

- Airtel India, Mobile Ad. 2007. Airtel Live!, Push-SMS. Openwave.

- Virgin Mobile USA. Mobile ad campaign SugarMama. 2006. Push SMS, WEB banners.

- China Mobile, Mobile Ad. 2008. WAP banners, Ad insertion into RingBackTone, Weather Forecast ad insertion, Missed Call ad insertion, MMS magazine.

- Wind Greece, Mobile Ad. 2007. Idle screen advertising. Velti.

- Vodafone Italy, Spain, Greece, Czech Republic. Mobile Ad. 2008 Vodafone Live! Banners, P2P SMS Intercept, idle-screen. Amobee.

- TIM Italy, Mobile Ad. 2007. P2P SMS, P2P MMS Intercept, WAP-banners. Mobixell.

Mobile Advertising still represent small amount of income. Operators are trying to find the most effective ways of interaction with Subscribers. Gartner supposes 1% of income of MNOs are related to Mobile Advertising and in 2012 this share should grow up to 2%-7%.

The current moment is very good for mobile advertising because all media agencies and advertisers are looking for new ways of advertising. Mobile advertising is very effective and very cheap same time. World experience tells that it is very significant to give relevant bonuses to Subscribers and perform opt in before feeding them with advertising.

Russian situation

In Russia almost all MNOs are thinking of Mobile Advertising. Megafon has many ad sites and launched several campaigns already. They perform this project on HQ level. Not sure whether it will lead to centralized carrier grade platform deployment but they are evaluating such possibilities. Some projections from Megafon Commercial Director Larisa Tkachuk could be found here.

Beeline is going to start a tender for this project for carrier grade ad platform. They already have good experience in Mobile Advertising (USSD tails in balance reports and several more). I think they will launch something in the end of this year, not sooner. Main problem is absence of even small amount of money in Vimpelcom. But Mobile Advertising is one of projects which could be simply started on revenue sharing basis (at least in the beginning).

MTS launched several ad campaigns too and preparing requirements to production platform. I heard that they are going to start this project in several months. At the moment they have MMS magazine and several more projects. You may find more detailed information here. It is a good time to offer a trial to them, I think.

So, mainstream of Mobile Advertising in Russia is SMS/MMS broadcasts and intercepts, WAP/WEB banners insertion in third party portals. At the end of last year MNOs performed attempt to align forces in this area but nothing serious appeared. Currently problem is not in deploying new system but in discovering huge potential of advertisements - this is extremly new channels and advertisers afraid of investing in a new channel while MNOs afraid of loosing loyalty of its Subscribers. The story just begins. Have a good time watching it and may be participating ;-)

Thanks,

Denis.

пятница, 15 мая 2009 г.

Industry exhibition

MTS stand was joint with AFK Sistema actives. Intellect Telecom, Komstar, Skylink, MTS shared one big stand. MTS was demonstrating several corporate VASes (LBS, Messaging, 3G) and new brand Omlet with video streaming capabilities on mobile and web. Dmitry Medvedev didn't visit AFK Sistema stand despite of presence of AFK Sistema owner Evtushenkov and many top managers like Shamolin (MTS), Pridancev (Komstar). Evtushenkov said that there is 90% possibility that Medvedev will attend AFK Sistema and I thought "Even such powerfil persons couldn't predict future. Hence the more detailed you could predict future the more powerful you are. It is not the matter of money, but it is the matter of analytical skills."

MTS stand was joint with AFK Sistema actives. Intellect Telecom, Komstar, Skylink, MTS shared one big stand. MTS was demonstrating several corporate VASes (LBS, Messaging, 3G) and new brand Omlet with video streaming capabilities on mobile and web. Dmitry Medvedev didn't visit AFK Sistema stand despite of presence of AFK Sistema owner Evtushenkov and many top managers like Shamolin (MTS), Pridancev (Komstar). Evtushenkov said that there is 90% possibility that Medvedev will attend AFK Sistema and I thought "Even such powerfil persons couldn't predict future. Hence the more detailed you could predict future the more powerful you are. It is not the matter of money, but it is the matter of analytical skills." Beeline. They had "Beeline City" stand. First of all Russian president paid attention to Beeline. He looked at Mobile TV (DVB-H standard). Another interesting features on their stand are: IPTV demo (Corbina) which recently commercial launched, Business services and 3G. President interest in Beeline could be thought as Government support to the company with shareholders war. They say that 1/3 of debt to pay in 2009 is already paid but very bad financials will push Beeline further down.

Beeline. They had "Beeline City" stand. First of all Russian president paid attention to Beeline. He looked at Mobile TV (DVB-H standard). Another interesting features on their stand are: IPTV demo (Corbina) which recently commercial launched, Business services and 3G. President interest in Beeline could be thought as Government support to the company with shareholders war. They say that 1/3 of debt to pay in 2009 is already paid but very bad financials will push Beeline further down. Megafon had similiar big stand with Smarts infront of it. They were quiet and as always green. They didn't show anything special but were presented. There are rumors that there was a message to all big telecom players to be presented at the exhibition in order not to be against Government willing to raise SvyazExpoCom power. Megafons so called MVNO Prosto was presented on different stand and was very popular.

Megafon had similiar big stand with Smarts infront of it. They were quiet and as always green. They didn't show anything special but were presented. There are rumors that there was a message to all big telecom players to be presented at the exhibition in order not to be against Government willing to raise SvyazExpoCom power. Megafons so called MVNO Prosto was presented on different stand and was very popular.

Denis.

четверг, 14 мая 2009 г.

Time to name a winner

I believe that it is not far from truth. Megafon was very successful in 4Q with anticrisis actions. Megafon acts according to market: enhanced bonuses, new tariff Prosto and even overall feeling that Megafon is the cheapest MNO helps them. MTS seems to be able not to respond to the crisis because of good financial conditions. But Beeline fastly loose its advantages over Megafon. Almost all projects are frozen, even significant ones. There is no contraction to the new environment. It seems that they don't realize that market changed, that new turns required. Possibly, it is because new top management haven't taken control of the company.

MTS is aggresively launching new projects in order to grow up VAS revenue. Megafon is concentrated on cheap proposals.

I believe that in near future Megafon will become number two MNO, Beeline will go down. It is not a good choice to hold Vimpelcom shares but MTS shares are still underscored I think.

Thanks,

Denis.

среда, 29 апреля 2009 г.

MTS bets on content

This project is one of the major events on VAS market in Russia. It is purely convergent service. Subscribers are going to have similiar experience from web and from mobile where they are able to get content: music, video, game, and socialize. MTS made mix of web TV and VOD, mobile TV and VOD, games and social capabilities. Main priority according to Pavel Roytberg is to attract significant subscribers base to this portal - to get them consume service. They plan to attract 500,000 subscribers till the end of 2009 and 1,600,000 one year later. Overall investments are thought to be about $5 mlns. The result could be seen in near future - will Omlet be our legal content shop?

This project is one of the major events on VAS market in Russia. It is purely convergent service. Subscribers are going to have similiar experience from web and from mobile where they are able to get content: music, video, game, and socialize. MTS made mix of web TV and VOD, mobile TV and VOD, games and social capabilities. Main priority according to Pavel Roytberg is to attract significant subscribers base to this portal - to get them consume service. They plan to attract 500,000 subscribers till the end of 2009 and 1,600,000 one year later. Overall investments are thought to be about $5 mlns. The result could be seen in near future - will Omlet be our legal content shop?

In Russia it is one of the first Mobile TV offerings with such a broad range of content. As example, Megafon Mobile TV still acts similiar to test zone with small amount of subscribers and live channels without any further development (solution is based on proprietary software with no features for enabling video in 2,5G networks). Beeline seems to have such a project in plans but facing huge financial problems at the moment and hence left all development projects on pause. So, MTS is confirming its status of VAS leader as from previous year VAS Conference. Moreover, it is one of the first projects in the world - there are single deployments of convergent web TV and mobile TV under single brand.

There is still a problem with piracy in Russia. Very small portion of content is being sold legally. But all change and this is not an exception. Soon legal content market share will grow and Content Shop projects will gain more popularity and revenue to its owners. And MTS bets on it. Long investments in right direction.

I believe that it could help MTS raise mobile traffic and gain revenue on content sales. I think that Content is one of the main trends in MNO business development aming others such as Mobile Advertising, Mobile Internet (traffic) and Mobile Commerce.

Thanks,

Denis.

воскресенье, 15 марта 2009 г.

Series of competitive analysis works (part 1)

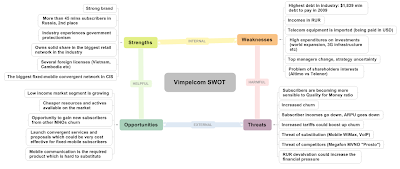

I'm begining the series of MNOs corporate strategy overview. They are made on my own observations and open sources of information (and a little bit of rumors :-) ). You are welcome to make your additions - I will be glad to post your thoughts.

The first part is short introduction to Vimpelcom (based on SWOT - I believe that it is very usefull way of short description of the company) which is pretty interesting to look at now because of its extraordinary situation.

Click to enlarge.

And below you may find current operational focus of Vimpelcom (from 3Q results presentation):

•Cut all non-essential costs

•Execute hiring freeze and identify further headcount optimization opportunities

•Aggressively re-negotiate contracts with key vendors

•Put on hold non-critical CAPEX orders

•Scale back CAPEX plans going forward

•Protect against currency volatility exposure through hedging

Second short overview is about MTS.

Current publich strategy of MTS is following (called "3+2"):

- Provide better subscriber experience. Differentiate network quality. Optimize CAPEX. Develop monobrand retail network.

- Develop data traffic and content based services. Balanced development of 3G and EDGE.

- CIS and developing countries expansion. M&A only in CIS in case of financial ability.

- Effective expenditures. Optimize OPEX. Switch CAPEX to strategic projects maintenance.

- MTS group development. Optimize business processes. Optimize organizational structure.

And finally, Megafon. This company seems to be the major threat for previous two MNOs.

Megafon has cost optimization activities but not so global as Vimpelcom and MTS. They don't have ambisious investments in foreign expansion, big retail network. They are very focused on cost effective proposal (MVNO "Prosto" - http://www.prostozvoni.ru/). At the moment they are performing restructurization (getting into the one company from several regional companies) but still active in their spendings on new solutions. It worths mentioning that Megafon is a closed company and not so limited by getting strong financial results. They are able to concentrate on subscriber base growth rather than USD revenue.

You may find pdf sources at the bottom of the page.

Thanks,

Denis.

четверг, 12 марта 2009 г.

Small portion of analisys

Yesterday MTS announced financial results. Consolidated net income down 6.8% due to non-cash FOREX loss through US GAAP translation of US dollar-denominated debt. This caused significant fall of its shares on NYSE (more than Vimpelcom). MTS was first of MNOs who published 2008 financial results. This loss is highly dependant from debt value which is more than Megafon debt but much smaller than Vimpelcom one. It is simply to predict that Vimpelcom results will be much worse and this will cause significant drop in its shares. At this point I advice to buy MTS shares after Vimpelcom financial results announced (it will cause chain effect and fall of MTS shares) but in 6 month perspective it is clear that MTS should be a leader in financial results. MTS has strong and aggresive market strategy - they are trying to attract new subscribers from different networks (its churn rate rose but I believe Vimpelcom churn should be higher) and develop poor market segment, but not so good as Megafon. MTS's spendings on advertising on the same level of quality from subscriber point of view. MTS started playing with tariffs and GPRS-internet traffic counting policies (increased since March 26th counting edge from 5kb to 100kb).

Vimpelcom due to Golden Telecom managers invasion to all relevant position is in very bad situation (frankly speaking, 2 debts from SberBank and icreased tariffs influence too) - bad corporate climate, big debt will cause much higher non-cash FOREX loss, new top managers will spend time on restructurization on Golden Telecom managers moving to relevant positions. At the moment I see that almost all strategy development of Vimpelcom is stopped - they are trying to survive in recession (as example MTS is cutting budget, looking for cost-savings and Vimpelcom is trying to find where it is possible to spend money from previous plans). Bad financial results and internal problems will have synergetic effect in shares drop. I believe it is good time to sell Vimpelcom shares. Their shares will be interesting in 6-9 months. It will be the time for effective actions of new management (maybe in worst case even some kind of nationalization), new experienced manager will have to decide strategy and find a way for business development. TV shows famous russian show man Fomenko with advertising of new lottery. Very interesting way of loosing subscribers - let's take last money from them - not far from stealing.

In same time Megafon is silently aquires new subscribers becuase of country wide feeling like Megafon is the cheapest MNO (recently it launched low income subscribers targeted MVNO called "Prosto" in russian sounds like "Simple"). I think its results will be good enough (don't forget that their debt is much smaller and they don't spend a lot of money on buying retailers businesses - I believe they are waiting for cheaper prices and hence for much more effective purchases).

I think Tele2 should be mentioned too. They began as discounter and unfortunatelly weren't allowed to be in Moscow but in other areas they are well presented. It is like magic time for them. Low income segment is incredibly fast growing (amount of subscribers in this segment). In case Tele2 is able to provide similiar range of essential services they will win from this crisis. It could be well seen from corporate segment - this segment replies first on hard time.

Thanks,

Denis.

воскресенье, 15 февраля 2009 г.

Lean and Mean Strategy

Here is the interesting letter I received some time ago from Carrey Sandera on my question about cost savings opportunities for MNOs.

I would suggest the Lean and Mean strategy. The Lean and Mean strategy will turn many mobile operators business upside down. Mobile operators will move focus away from doing everything themselves, to instead letting external partners handle a great many of the tasks that mobile operators today consider as part of their core business.

The most revolutionary and significant characteristic of the Lean and Mean strategy is that the mobile operator will stop marketing themselves as an independent brand and instead operate as a "carrier's carrier". The business model is based on renting network capacity to other mobile operators, MVNOs, SP’s etc. Customers will thereafter only be serviced by various types of wholesale customers via many different brands. For the mobile operator it is important to be able to attract the "correct" wholesale customers - in other words wholesale customers that can attract many consumers and generate high network traffic, as it will be these wholesale customers that will give the mobile operator a profitable business case. The "correct" wholesale customers could be wholesale customers that currently offer other telecom services in the form of IP telephony or cable TV etc. where mobile telephony would be an excellent supplement for them.

For the mobile operator, the level of costs is very important when competing in attracting wholesale customers and outsourcing - and the use of partnerships - is an important part of the mobile operators’ business model and essential in the quest to achieve a more cost-effective operation. Tasks that previously were considered part of mobile operator's core competencies will increasingly be outsourced to external companies that will be able to handle these tasks more efficiently and at lower cost. This will be the case for e.g. the operation and service of the mobile network operators, where a number of mobile operators have already outsourced the daily operation of their network to other companies.

Outsourcing is not new for mobile operators and has been used before to reduce costs or make costs variable. What is new is the business areas that the operators are choosing to outsource to minimize their costs. Many of the business areas that operators are focusing on are areas that most operators today perceive as part of their core business. This is why these business areas have traditionally not been taken into consideration as possible outsourcing areas. With the Lean and Mean strategy, mobile operators will attempt to ensure that the most possible fixed costs become variable, partly to better be able to adapt to changes in the market and partly to find cost savings.

When using the Lean and Mean strategy, the mobile operator has no direct costs in connection with acquiring individual end-users, as those costs are maintained by the wholesale customers. The mobile operator will therefore have a positive accumulated cash flow on all customers from the first day and the mobile operator can achieve far better earnings as one of their most significant expenditure items (SAC) - that is up to 25% of many operators total costs - disappears. Alternatively operators can also utilise the saving to reduce the various network prices that their wholesale customers have to pay, to thereby hopefully attract more wholesale customers to use their network and thereby become more competitive and achieve a larger market share.

When using the Lean and Mean strategy, the mobile operator only retains the most essential part of their business in-house, while the rest is outsourced to minimize costs. The essential parts of the operators business are:

• License

• Billing system

• Network-centric services/platforms

Other areas that are central to the operators business are:

• Outsourcing

• Wholesale customers

• Network coverage

• Telemetry

• Add-on products

• Hosting services

Than using the Lean and Mean strategy will to try to significantly reduce their CAPEX compared to previously. Mobile operators will try to ensure that they do not bind capital in tangible assets like for example infrastructure, that the mobile operators traditionally have invested billions of Euro in. This will be a break with tradition as the investment in - and operation of - mobile infrastructure has up to now being considered as one of the mobile operators most important core competencies.

суббота, 14 февраля 2009 г.

Cost saving proposals

I would like to begin my post from short introduction of macroeconomy influence on companies. Economists divide time periods into economic growth and economic downturn. Reasons and results could be different but companies strategies were determined long ago:

- Gain as big as possible market share during economic growth or market growth

- Gain maximum efficiency during financial downturn

The most cost effective player will spend extra funds on enhanced value proposal (for subscriber) and finally will get better financial results. In this post I'd like to tell about cost saving solutions which could bring additional efficiency and even revenues to MNOs.

- Energy Consumption. Energy savings is a direct way for cost savings. You may find broad range of solutions for this purpose: PC terminals energy savings (as example http://www.greensnapper.fi/component/option,com_frontpage/Itemid,1/lang,en/ ), RAN energy saving with special antennas ( Ericsson activities http://www.ericsson.com/ericsson/press/facts_figures/doc/energy_efficiency.pdf ) and even means of virtualization for data centers. Main task here is to find minimal CapEx for initial deployment.

- Managed Services. Hosting and outsourcing are well know ways of decreasing expenditures and hence increasing revenues. In these cases operator doesn't spend on hardware, maintenance engineers, energy consumtion and many more. Managed services could bring world wide experience to MNOs additional services with minimal expenditures. For more detailed information have a look at http://www.gemalto.com/telecom/allynis/

- Lean and Mean strategy. Detailed description could be found in separate post (http://rustelco.blogspot.com/2009/02/lean-and-mean-strategy.html).

- RAN&IP sharing. Many MNOs from Europe and Americas share their RAN and IP networks. Well known fact - Russia is huge. It is very expensive to have own channels all over Russia. All MNOs from "Great Three" invested a lot into building their national channels. Some areas in Russia are very hard to make good coverage, as example Far East. Belorus Government as I think made very wise step. They require to share networks of MNOs. Really, it is foolish to have 3 antennas sites of 3 MNOs in one place. It is clear that there are hidden great cost savings through sharing.

- Device-based self care (&call center optimizations). Main solution is to decrease number of call center calls and hence decrease call center expenditures (which are pretty big in MNOs budget) by implementing device-based self care product. This application is being launched in case of calling to MNOs self care IVR. Main relevant information is being received through GPRS channel (which is much more effective rather than IVR channels). Subscriber gets his account info, services management and even special services promotion on top of the application screen. You may find several interesting articles in Internet regarding SNAPin solution which was implemented in several European MNOs. Later this company was bought by Nuane and product now is called Nuance Mobile Care.

- Fraud Management&Revenue Assurance. Well known fact that 5%-15% of Income in Telecom are going to Fraud losses. So, implementation of such systems could bring 5%-15% of Income increase. Almost all big MNOs already have implemented such systems but small and middle MNOs remain fraud affected.

- RAN optimization. There is niche of solutions for RAN optimization. Such solutions help Network Department managers to optimize their expenses on building and operating mobile networks. Main cost savings are contained in using real data to determine low coverage areas and making decisions to deploy Femtocells, repeaters, or strategically placed new sites, maximising ROI with limited budget. Network issues could be discovered with real time Subscribers experience. This help to improve engineering efficiency in resolving customer complaints hence minimize OpEx. The end result is better quality RAN helps MNO to decrease churn. I would recommend looking at www.arieso.com and check their products for this area.

- Mobile Internet data optimization. Gaining popularity unlimited data tariffs could bring a lot of head ache to MNOs. It is very desirable to prevent Subscibers from Not Fait Use of Mobile Broadband. As example, Camiant Multimedia Policy Engine was deployed in one of Vodafone countries. It helps to decrease bandwith of subscriber channel after breaching 2Gb monthly limit. Many Subscribers are using torrents which could eat very big portion of traffic. There are solutions helping to minimize torrents traffic (performing caching of such data). Another thing here is to compress Mobile Internet traffic (especially when it is unlimites). MNOs could find here direct cost savings on data transmission while Subscriber could experience faster web pages downloads.

- Telecom Expense Management. Frankly speaking it is not directly for MNOs. This is for their corporate Subscribers which are very interested in cost savings too. They will find a way to decrease their telecom expenses but it will be better if their Operator provides them means of telecom expenses analysis. In this case MNO could gain additional money but not only loose on minimized expenditures from Enterprizes. More detailed information could be found on EZWim site (http://www.ezwim.com/) and their blog (http://www.telecomexpensemanagementblog.com/).

As always I'll be glad to get your thoughts and feedback.

Thanks,

Denis.

суббота, 24 января 2009 г.

Corporate proposals from Mobile Operators

MNOs always relied on corporate subscribers as major revenue generators. This is very significant to maintain corporate subscribers loyalty and one of the best ways of this is providing of special corporate services. As example MTS is trying to attract new subscribers through offering mobile communications to corporate subscribers family members. You may found plenty of corporate proposals on web sites of leading MNOs in Europe and USA:

- http://www.t-mobile.co.uk/business/services/

- http://www.o2.co.uk/business/corporate/productsandservices

- http://www.vodafone-dataworld.co.uk/default.aspx?pageId=21

I was looking for the most promising innovatove proposals which could bring new opporunitites for MNOs. Below you may find short list of them. I'll provide presentation a little bit later. At this moment let's simply realize their potential. Most of these services could be launched with minimal investments from MNO and this is very valuable in nowadays turmoil. Spendings needed only for MNO branding and hosting preparations (no investments into hardware).

- Soonr (www.soonr.com). Promising service which already gained popularity all over the world. This is Sales Force Automatization task mobile implementation. Another popular term for such kind of software is Cloud Computing. Mobile employees could be powered with remote access to corporate internal documents storage. Main tasks which could be performed:

- Publish documents from mobile device (smartphone). As example works made Acts could be published from client site. All these documents are stored in reliable (with copies) storage.

- Access documents through mobile portal (contracts, proposal, presentations, templates etc)

- Collaboration tools and - so called mobile work flow

- Documents printing/faxing/emailing

Corporate portal for services and applications management. It is an essential tool like App Store for iPhones. Such a solution is a starting point for driving corporate VASes promotion. Special business cases for business process mobilization and tools for this should be stored here. Moreover it is the place for MNO Partners to promote their developments.- Range of special PBX offers. As example, 2N (http://www.2n.cz/index.html) – broad range of corporate solutions. The most interesting of them are mobile PBXes and Virtual PBX. There is a strong trend for CAPEX and OPEX minimization in SMEs budget. This is very comfortable to buy small box and make office IVR enabled. This is fast and cheap way to gain new level of clients interaction for SME. Definetly such solutions will gain popularity. Here you may find info about Telefonica activities (http://www.2n.cz/company/references/customer_references/telefonica_o2_resells_2n_products.html)

- Nuance Mobile Care gives ability to manage corporate smartphones (it is not the only purpose of this solution). Operator could bring IT deparment or itself manage corporate mobile devices in order to increase corporate VASes penetration, boost additional services using (email, corporate applications, especially different mobile CRM access and so on).

- LBS integration solution. This could bring new revenue from corporate clients which would like to automatically collect location information of courires and other mobile employees.

- OTA backup&restore in corporate implementation. Storage of long list of contacts on server side, text and other messages, call history, alerts and so on. This could bring special feature - calls detalization where numbers will be replaced with contact names from phone book. As example, Gemalto (http://www.gemalto.com/) is able to provide such opportunities (http://www.gemalto.com/axalto/Company/press/pdf/T_Mobile_Slovensko_en.pdf).

- Carrier grade solution for IT managers alerting by SMS/Voice/MMS – standard procedure of client monitoring system integration should be provided.

- Scanr( www.scanr.com ) – replacement for faxing in some cases.

- Telecom Expense Management system. Allows corporate clients to manage their expenses on telecom.

I'll be glad to discuss other opportunities and get your comments on these VASes.

Thanks,

Denis.

воскресенье, 11 января 2009 г.

Knocking on the right door

First of all in current situation Megafon is in my opinion the most probable buyer. Megafon debts are lowest among Russian MNOs. Megafon has a lot of ways for improving it's business with different innovative projects.

Megafon has Head Quaters (HQ) in Moscow but many decisions are being made in St. Petersburg - Megafon's homeland. All regional subsidiaries were independent companies that's why often buy decision was made on regional level. MTS and Vimpelcom have centralized structures and all projects were going through Moscow HQ. Finally decision to centralize Megafon was approved. http://megafon.ru/news/newsarhive/11586/

It means that Megafon should take same structure as MTS and Vimpelcom. I think it will increase HQ departments ability to influence on decisions. The management should become more centralized in same time current relationships with regional Megafons could loose their wheight. Further standartization should be mentioned too. Soon Megafon should perform IT and technological infrastructure standartization in order to get the most possible synergy effect. As example there are different Call Centers in different regions supported by different vendors and SIs.

An additional consequence of this restructurization could be the temporary delay in making deals. I think such step will take not less than a quarter and in summer time Megafon will be ready for business cooperation. I do not take into consideration that this step will allow Megafon gain publicity on Stock Exchange.

Another piece of information is in a reorganization of managing companies. New attempts of gaining synergy should be taken soon according to Vedomosti (http://www.vedomosti.ru/newspaper/article.shtml?2009/01/11/176209). Vladimir Zhelonkin (former SvyazInvest executive) became "AF Telecom Holding" CEO. And his main task is to provide synergy between different actives of Alisher Usmanov. Concrete actions should be discussed during Board Of Directors of TelecomInvest which includes directors from media and internet actives of Mr. Usmanov. It means possibility of huge amount of new innovative projects around Megafon.

List of actives: Mail.ru, Odnoklassniki, Vkontakte.ru, HeadHunter.ru, Freelance.ru, Livejournal.com, Gazeta.ru, Newstube.ru, "Kommersant Holding", "Muz TV", "7 TV". All these projects could gain synergy effect in Megafon networks and among Megafon Subscribers. I believe it is a good opportunity for vendors and SIs to offer their services in deploying innovative mobile features.

What do you think about Megafon?

Will it be easier to cooperate with Megafon?

How soon positive effect will be?

Is it a good time for such step?

Thanks,

Denis.

четверг, 8 января 2009 г.

Downturn economy predictions and trends

Subscribers begin to perform much more detailed analysis of their spendings. MTS first took this paradigm with New Year tariff advertising as I mentioned in previous post.

I'd like to share my thoughts on Russian Mobile market trends in 2009:

- MNOs will launch several 3G oriented services. After spending millions on 3G infrastructure it is strongly required to fill networks with content services like Mobile TV, Mobile Radio, Video Calling services. Russian Great Three MNOs have project groups for such projects and already performed some investigations of launching such services. Some vendors offered their experience and systems. In 2009 commercial launch should be made.

- Mobile Advertising. It could be additional revenue generation factor from WAP/WEB banners insertion, SMS/MMS peer to peer ad insertion and of course MMS campaigns with rich content ads. 2009 could be the starting year of these activities.

- Simple Video Call propositions.

- Device based Mobile Internet. Widgets, specialized portals, new internet offerings, branded internet web browsers will be started for evaluation.

- Mobile Commerce. MNOs will enhance their activities in attracting Subscribers to mobile payments. This interest was emphasized at the conference. http://www.mobilepaymentsrussia.ru/

- Mobile Broadband. MNOs will try to compete with mobile broadband offerings like Yota (www.yota.ru). Special flat rate tariffs will be proposed. As example Vimpelcom already propose switching to Apple Fresh tariff (with unlimited GPRS internet) with other than Apple iPhone models. Hence IP compression and optimisation tools will take popularity (P2P traffic optimisation etc).

- Pricing wars. In downturn time there is a big desire to attract more Subscribers with special anticrisis discounts. This trend already seen on market. Additionally advanced discounts could be entered on market - as example cell load discount (discount when nearest cell isn't loaded) in order to spread load on network and hence increase cpacity, delayed content delivery discount (get content later while network isn't loaded for cheaper price).

- Content portals improvements. More content, much easier access. Megafon and Beeline will try to reach MTS portal success.

- MNOs will increase their efforts on corporate Subscribers attraction. Beeline will use its Golden Telecom actives for such proposition. Megafon is going to build it's own infrastructure, MTS will increase collaboration with Komstar. As example special office GSM routers could gain popularity (http://www.megafonnw.ru/info/rus/news/pressreleazes/mobile_cabinet_3grouter.html).

- Much stronger requirements to ROI of vendors offerings. I think will be initiated projects with ROI in less than 1 year.

- Closer integration and cooperation with retail industry to gain additional revenue.

- Branded phones proposals. Modu phones, Huawei etc.

- MVNO developments and startups. But I'm sure in their unsuccess except ad funded mobile communications like in Blyk.

- All MNO will try to gain minimization of investments and proposition of revenue sharing models with almost zero investitions. In case some system integrators could provide end to end solution (system infratructure, deployment, licenses, content) they could be a leader in tenders on such systems.

- MNOs will try to attract independent software developers like Orange, T-Mobile, AT&T do (http://developer.t-mobile.com/site/global/home/p_home.jsp). So called application stores could gain popularity.

- Maybe Beeline and Megafon will realize that content aggregators are the showstoppers in their content success. :-)

Additionally I'd like to add these thoughts:

http://mobile-thoughts.blogspot.com/

http://www.m-trends.org/2009/01/mobile-and-wireless-predictions-for-2009.html

Thanks,

Denis.

New Year outdoor campaigns

During Russian holidays I was wondering about primary focus of "Great Three" MNOs. Of course one of main direction for promotion of MNO is outdoor advertising. I spent about 12 hours driving through Moscow biggest roads and overall route is about 700 km.

MTS is almost 100% concentrated (as Jack Trout proposed in "The marketing Warfare") on New Year tariff promotion: outdoor, TV ads, movie in cinemas, portal. This is very strong offer: cheap price inside MTS network and very expensive outside it, strong advertising campaign on TV screens, New Year magic theme. The main advantage of MTS is sharply directed campaign - all forces aligned to be the main New Year offer. I bet that it will give significant results on subscriber base growth rate of MTS during first quarter.

MTS is almost 100% concentrated (as Jack Trout proposed in "The marketing Warfare") on New Year tariff promotion: outdoor, TV ads, movie in cinemas, portal. This is very strong offer: cheap price inside MTS network and very expensive outside it, strong advertising campaign on TV screens, New Year magic theme. The main advantage of MTS is sharply directed campaign - all forces aligned to be the main New Year offer. I bet that it will give significant results on subscriber base growth rate of MTS during first quarter.In same time Beeline divide efforts on advertising its iPhone proposal, interesting Roaming offer, Optimal Budget (SME proposal). iPhone is not hot theme and I'm pretty sure that without exclusivity for Beeline it is mistake to advertise it. Those who need iPhone already bought it, others know that it pretty simple to buy it now from every MNO. I do not understand aggressive Roaming advertising - it isn't the key factor for significant amount of Subscribers especially in downturn economics. Optimal budget is a new proposal for SME segment - the worse design I've ever seen - white text on yellow background impossible to read. Idea is very good for crisis time but implementation is very hard to understand. I remember Sonet proposal of 1998 crisis solution - "Anticrisis" tariff - it gained popularity very soon $2,5k for lifetime contract. Beeline has relatively small amount of bonus ads which I found interesting (because of New Year theme and 10% payment bonus). Summary for Beeline - very ineffective way of spending advertising budget.

Megafon has relatively small amount of outdoor ads. It seems that they try to meet their audience in other places. As example they had sponsorship contract with russian business TV channel RBC, a lot of ads in industry magazines. Additionally Megafon performed pilot launch of branded mobile phone (with Huawei) in North West region. Idea is to make present package for New Year holidays. http://www.vedomosti.ru/newspaper/article.shtml?2008/12/08/172628 Additionally I'd like to mention that subway halls are full of Megafon advertising. Interesting targeting but do not forget that russian subway isn't a poor people way of transport.

As short summary, it is clear seen that MTS is performing aggresive campaign vs dispersed (after Golden Telecom merge) Beeline and Megafon. Soon Megafon and Beeline will be seeking for answering tools: unlimited internet, special discounts, new services offering (a.e. branded phones).

What do you think about most effective ad campaigns? May be some advice from European and Americas campaigns?

Thanks,

Denis.

вторник, 6 января 2009 г.

Small portion of analytics

The most interesting part of it below on picture. This is debts of MNOs before crisis according to their official financial reports.

You may see significant increase of Beeline debts after Golden Telecom and Corbina aquisition. Of course not all debts should be paid in 2009 but it is very hard to refinance debts in current situation. I think it is the answer on expenditures cuts in 2009. Beeline will have to spent almost all revenue on debts and there is no way for many new projects.

MTS and Megafon already refinanced part of their debts and able to compete for Beeline market share with aggressive strategies. They have already begun this - in the same article there is information about average minute cost (APPM) going down in MTS and Megafon while Beeline increased it.

Thanks, Denis.

пятница, 2 января 2009 г.

Mobile VAS cases

Here http://www.slideshare.net/dangerden/mobile-vas-20-cases-presentation you may find my presentation available for download about gaining popularity mobile services all over the world. I'll be glad to get your feedback.

Thanks,

Denis.